Practice Management Insights from the Kehrer Group Benchmarking Surveys

Kehrer Group research has demonstrated repeatedly that financial institutions tend to have too few financial advisors given their opportunity. Not only is adding advisors the most direct way to grow the retail wealth management business, adding advisors actually increases revenue exponentially —firm revenue increases by more than the incremental production of the new advisors. That is because divesting some clients from existing advisors, reducing branch assignments, and moving some advisors to second story settings where they no longer receive referrals all make the existing sales force more efficient.

But in a world of a growing advisor shortage, reluctance of bank and credit union management to add headcount, and burgeoning growth among financial institutions, many banks and credit unions are losing ground in the effort to increase advisor coverage of the institution’s opportunity.

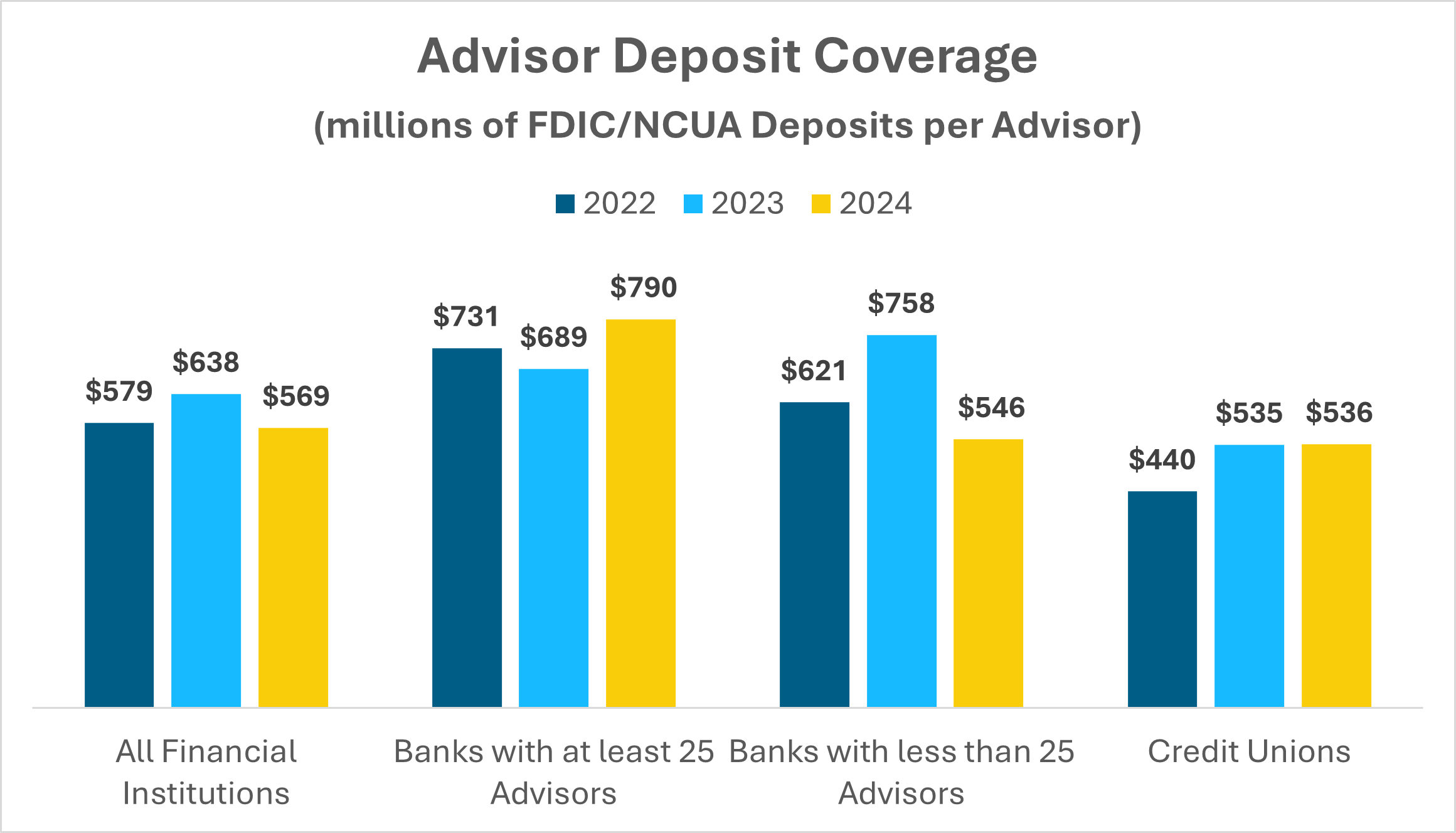

One measure of that opportunity is the size of the institution’s core or share deposits. By that measure, on average advisor coverage in financial institutions improved last year. The typical firm deployed one financial advisor for every $569 million in core deposits, 11% thicker advisor deposit coverage than in 2023, the result of significant growth in advisor headcount in banks and credit unions.

This improvement in advisor deposit coverage was driven by banks with less than 25 financial advisors, which increased advisor headcount by 6.3%. Their 2024 average of $546 million in deposits per advisor is 28% thicker coverage than in 2023. On the other hand, the larger banks lost substantial coverage, even though their advisor forces grew 3.2%. Their ratio of core deposits per advisor worsened 29%, year over year. Credit unions just maintained their advisor deposit coverage after a strong net recruiting year, growing advisor headcount 7.2%

What’s happening here? The strong growth in deposits is creating headwinds for firms seeking to improve advisor coverage, and the shift of deposits to larger banks is having the most impact on banks with at least 25 advisors.

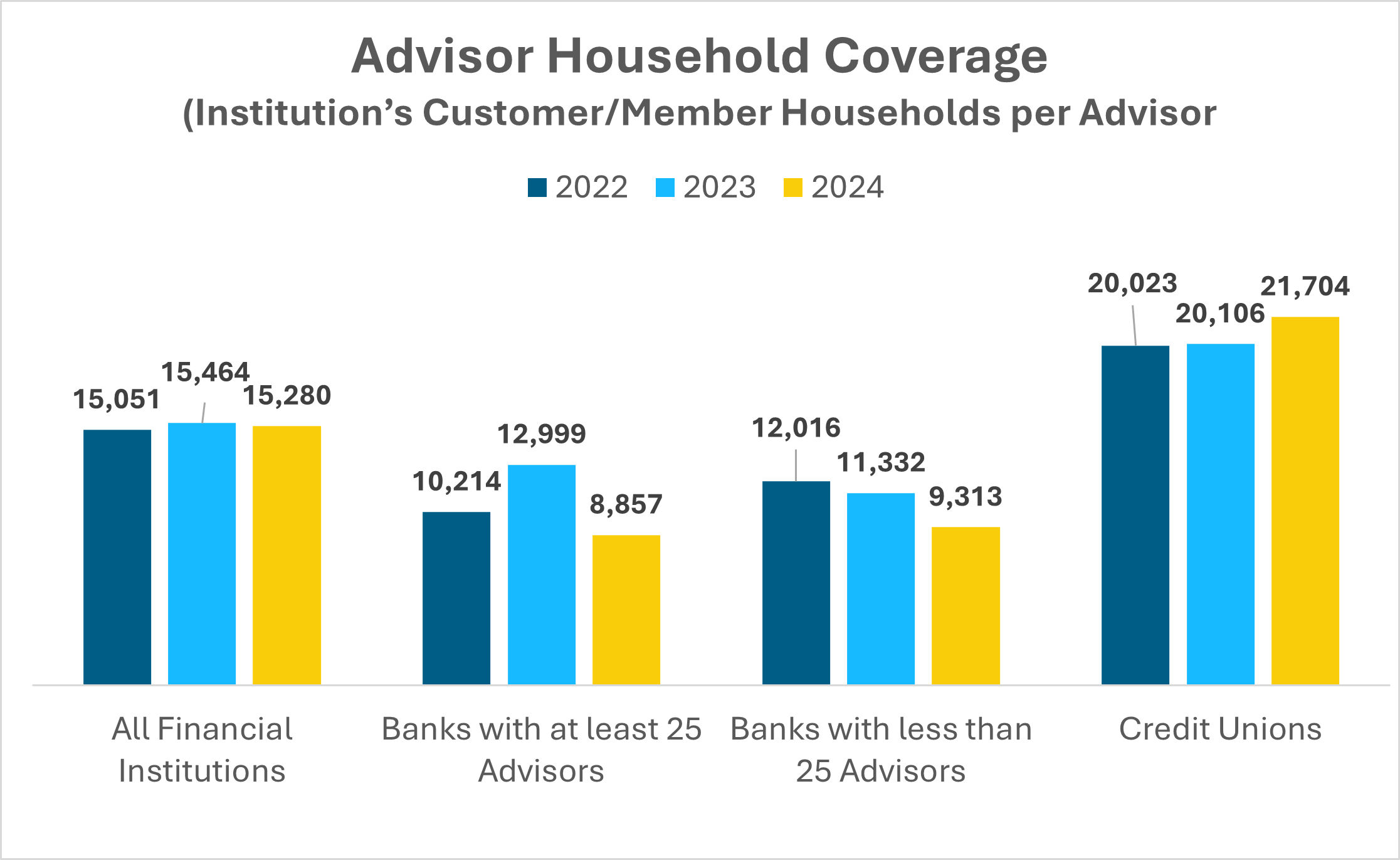

Given the volatility of deposit movements, advisor deposit coverage is a weak measure of whether an institution has sufficient advisors to cover its opportunity. One alternative measure is advisor household coverage—the number of advisors relative to the size of the institution’s customer or member base.

Viewed through that lens, we have a different picture of advisor coverage. Overall advisor household coverage has been flat for the past few years.

Banks of all sizes improved their advisor household coverage this past year, with the largest relative improvement in banks with at least 25 advisors – 32% thicker household coverage. Credit unions, which have much lower deposits per member household than deposits per bank customer household, saw their advisor household coverage thin out some.

So, a mixed picture. Two things are clear, however. Household wealth is experiencing strong growth, and banks and credit unions are losing market share (Cerulli, US Broker/Dealer Marketplace 2024). Adding more advisors could reverse that trend.

“At Financial Resources Group, our focus is squarely on enabling advisors to right size their books organically and strategically, and data gleaned from the Kehrer Group is invaluable in helping us achieve that process,” said Chris Thompson, SVP, Divisional Director with Financial Resources Group, powered by LPL Financial. “We believe that an advisor’s success is best measured by the quality of client relationships, the depth of their expertise, and their ability to effectively serve their chosen markets – not by the square footage of a territory.”

About the Data

This Highlighter draws on data from the 2024-2025 Kehrer Group Benchmarking Survey. Kehrer Group has been benchmarking the investment services business in financial institutions since the early 1990s. 183 banks and credit unions, which deploy 4,546 advisors, participated in this year’s survey during the first quarter of 2024. We publish the survey findings in three segments:

- Firms with at least 25 advisors (sponsored by Cetera)

- Firms in Regional & Community Banks with less than 25 advisors (sponsored by Ameriprise Financial Institutions Group and Financial Resources Group)

- Firms in Credit Unions (sponsored by Ameriprise Financial Institutions Group and Financial Resources Group)

About Financial Resources Group

Financial Resources Group was founded with a powerful commitment to serve, spearheaded by a team passionate about helping financial professionals and institutions achieve superior results. Our roots are firmly planted in supporting financial professionals utilizing the LPL Financial platform, and from there, we strategically expanded our services to include financial institutions, dual programs, and independent financial advisors. Now, fully integrated with LPL Financial, Financial Resources Group leverages its enhanced scale and comprehensive resources to deliver even greater value to our advisors and partnering institutions.