Practice Management Insights from the Kehrer Group Benchmarking Survey

As the business of financial advice has shifted from generating transaction revenue to asset-based compensation, organic asset growth has become an increasingly important metric for directors of retail wealth management in financial institutions. Each advisor is tasked with capturing new assets every year to fuel the growth expected by the institution.

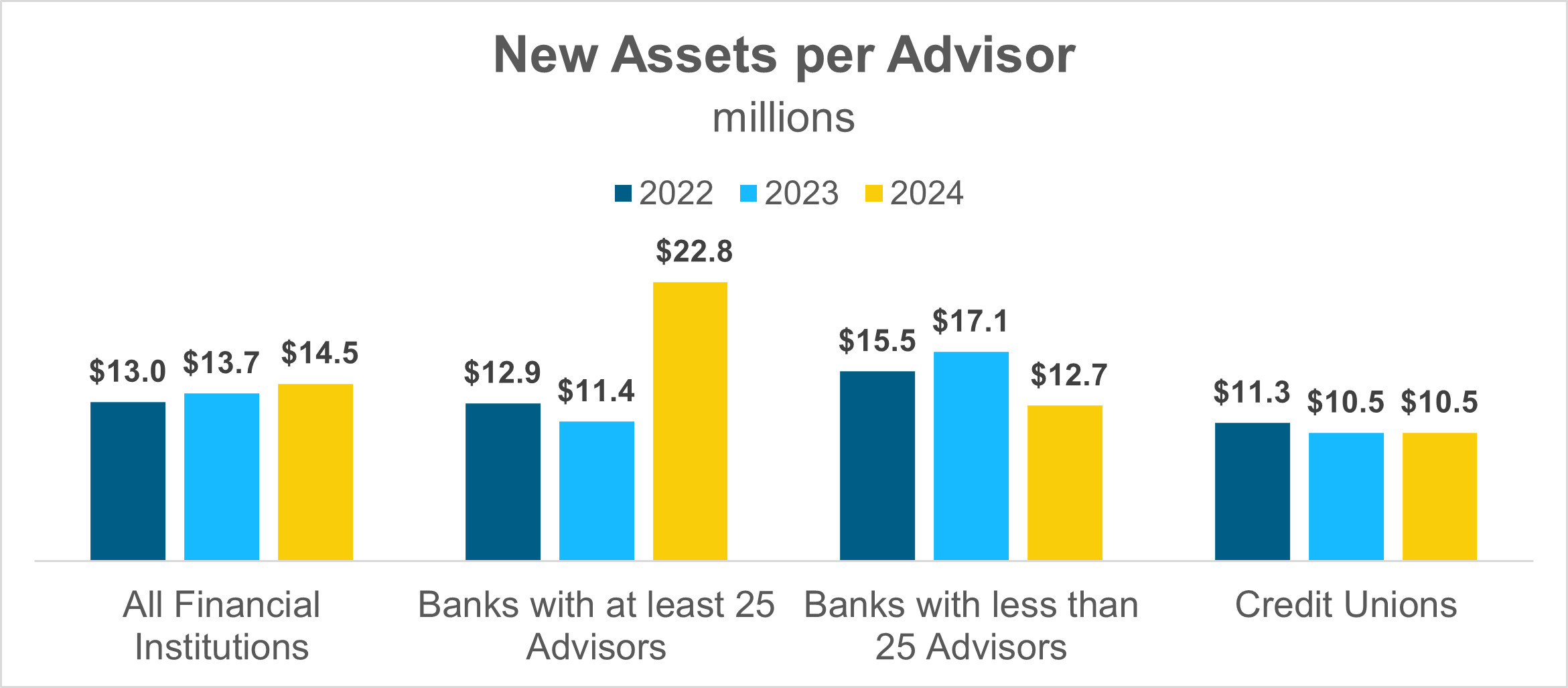

Last year the typical financial institution-based advisor acquired $14.5 million in new assets, continuing the 5% or 6% improvement year over year we have observed recently. But the different segments of the bank-based advisor community tracked by Kehrer Group have quite different experiences.

The banks with at least 25 advisors doubled their asset acquisition after some slippage the previous year. On the other hand, advisors in smaller banks brought in 26% less assets than in 2023, after a 10% gain the previous year. And asset acquisition among credit-union based advisors was flat last year, after some slippage previously.

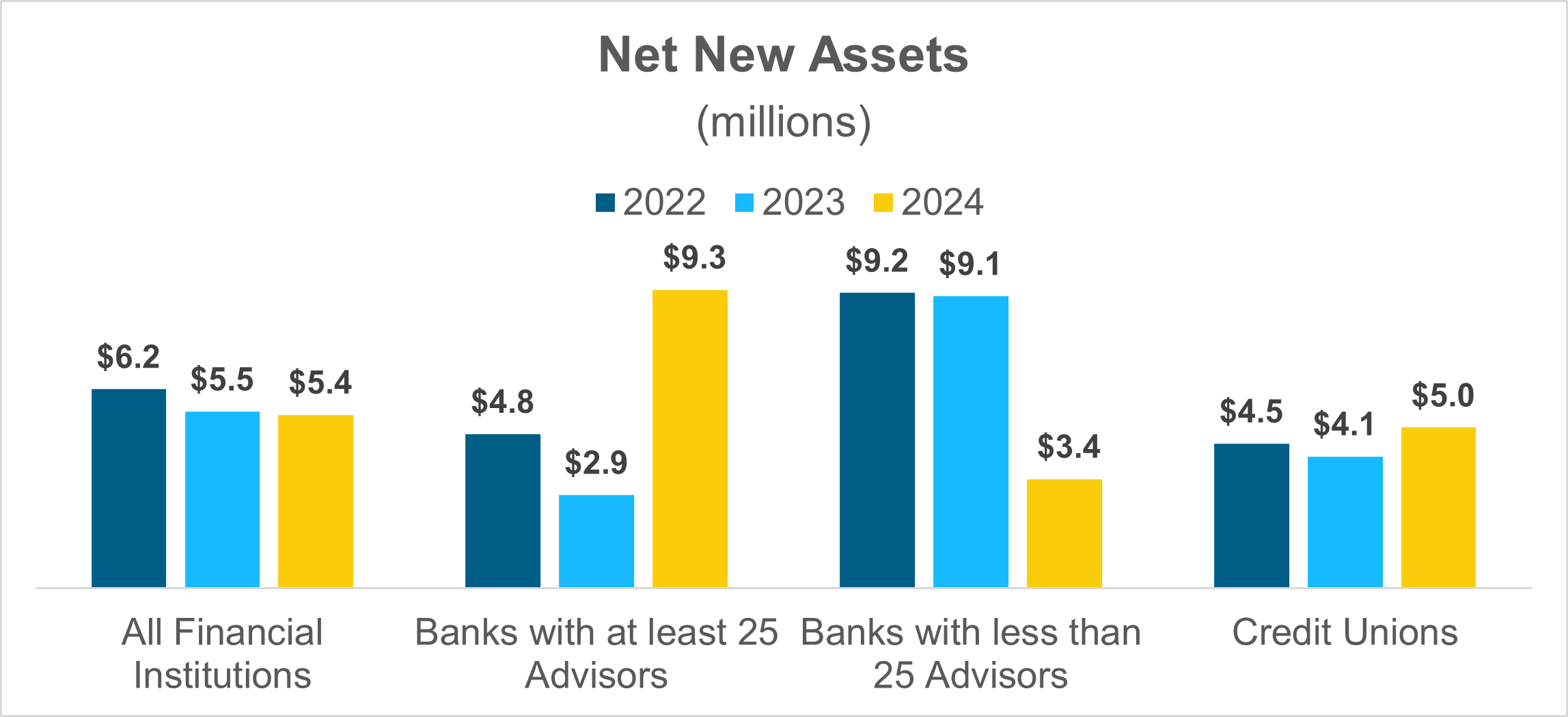

But while advisors are acquiring new assets, they are also losing assets out the back door, as some clients spend down their savings, or clients depart. Let’s focus on net new assets—acquired assets minus assets that have left the firm. While new asset acquisition improved modestly last year, the growth in net new assets actually slipped slightly; advisors in banks and credit unions added $5.4 million in net new assets last year, down 13% from two years ago.

Average net new assets in the smaller banks were only $3.4 million last year, down from their usual level of more than $9 million. The shortfall was due to both a 25% decline in asset acquisition, and $9.3 million in attrited assets.

The large banks tripled their average net new asset acquisition, after tepid performance in 2023. They doubled their asset acquisition from the previous year, while losing $9.3 million to attrition, on average.

Advisors in credit unions increased their net new assets 22%, despite flat asset acquisition. Credit union-based advisors lost only $7.6 million in assets to attrition.

These findings underscore the challenge of growing assets in the face of asset attrition. Like trying to fill a bucket with a hole in it, advisors need a substantial level of new asset acquisition just to stay even. Is there a certain amount of attrition that is inevitable (i.e., death, systematic withdrawals)? Are there mitigation tactics that can avoid other kinds of attrition?

Credit unions fare somewhat better, with lower asset attrition per advisor on average than advisors in banks. Is this due to differences between the characteristics of bank and credit union clients? On the other hand, bank-based advisors have more assets on average than credit union-based advisors, and advisors in the large banks have substantially more assets each than their peers in small banks. Regardless of the segment, financial institution-based advisors tend to lose about 10% of their assets every year.

Driving net new assets is essential not only for the growth of a financial institution but also for the retention of those assets. Your return on investment comes from being the leader who captures a greater share of your clients’ wallets.

Cetera empowers financial institutions and advisors through AdviceWorks®, a comprehensive platform designed to increase wallet share and strengthen client relationships. Key features include:

- Robust Client Portal for seamless engagement

- Advanced Time Segmentation for retirement income planning

- Asset Map for visualizing client holdings

- Financial Planning Tools such as MoneyGuidePro®

- Marketing Central for ongoing digital client communication

- Wealth Management Integration Services to unify trust, brokerage, and banking data into one cohesive experience

Beyond technology, Cetera delivers sales growth and coaching support through our experienced Regional Growth Teams. We deliver hands-on coaching and sales support, partnering with every level of your organization from the C-Suite and Heads of Wealth Management to program managers, financial professionals, licensed bankers, and sales assistants. Together, we help you deliver what matters most: enabling clients to achieve their financial goals.

About the Data

This Highlighter draws on data from the 2024-2025 Kehrer Group Benchmarking Survey. Kehrer Group has been benchmarking the investment services business in financial institutions since the early 1990s. 183 banks and credit unions, which deploy 4,546 advisors, participated in this year’s survey during the first quarter of 2024. We publish the survey findings in three segments:

- Firms with at least 25 advisors (sponsored by Cetera)

- Firms in Regional & Community Banks with less than 25 advisors (sponsored by Ameriprise Financial Institutions Group and Financial Resources Group)

- Firms in Credit Unions (sponsored by Ameriprise Financial Institutions Group and Financial Resources Group)

![]()

About Cetera® Financial Institutions

Cetera Financial Institutions is a marketing name of Cetera Investment Services LLC, one of the largest self-clearing registered broker-dealer firms that exclusively serve bank and credit unions across the country. They are a leading strategic partner to its affiliated financial institution in offering holistic and integrated wealth management services, dedicated regional growth team support, and service with a purpose. Cetera Investment Services helps institutions expand their financial offerings, deepen client relationships, and drive growth—all while helping clients pursue their financial goals through an advice-centric approach.

Cetera Investment Services LLC and Cetera Investment Advisers LLC are members of Cetera Financial Group®, which provides leading wealth management and advisory platforms and innovative technology to financial advisors and financial institutions nationwide. As of Sept. 30, 2025, Cetera firms manage approximately $625 billion in assets under administration and $284 billion in assets under management. Advisory services are offered through Cetera Investment Advisers LLC, an SEC registered investment adviser firm, where financial institutions and advisors receive a wide array of solutions and back-office support, so that they can focus on clients. Cetera Investment Services is a member of the Depository Trust and Clearing Corporation (DTCC), the Securities Investor Protection Corporation (SIPC), and the Financial Industry Regulatory Authority (FINRA). For more information, see www.ceterafinancialinstitutions.com.