Kehrer Group Research Finds That They Do

Advisors in banks and credit unions continue to disappoint their directors’ aspirations to embrace financial planning in their practices. In last year’s Kehrer Group benchmarking surveys, the average bank-based advisor had less than 29 active planning clients, only 7% of the 408 clients in the advisor’s book.

The reasons we hear for this shortfall? Planning takes time away from closing business. Too much time is already eaten up by branch activities, the need to travel among branches, and having to spend time with referred customers who do not have much to invest.

These issues go away for those advisors who move out of the branches to standalone offices or into other departments of the institution, e.g. commercial, mortgage, the private bank, etc. In what has come to be called “the second story” office, they are freed from the distractions of the branches, low value referrals and windshield time, and can focus on going deeper with their existing clients.

Do the growing number of second story advisors actually do more financial planning?

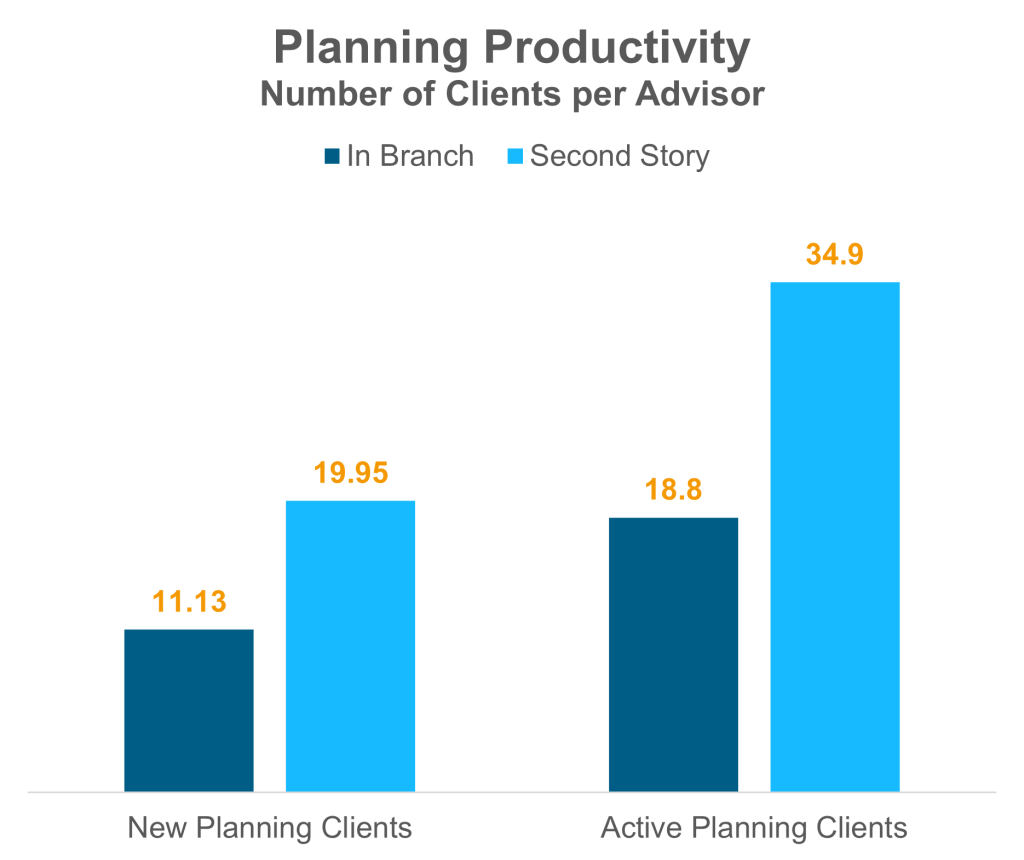

For an answer, Kehrer Group turned to its proprietary database of 3,000 individual advisors from 175 banks and credit unions. We found that the average second story advisor had 34.9 active planning clients—clients that had experienced some planning activity in the past two years. That is 86% more active planning clients than the average branch-based advisor.

And that gap is becoming larger, because the second story advisor is engaging with new clients about planning at a faster rate than the branch advisor. The average advisor-initiated plans with about 20 clients during the year.

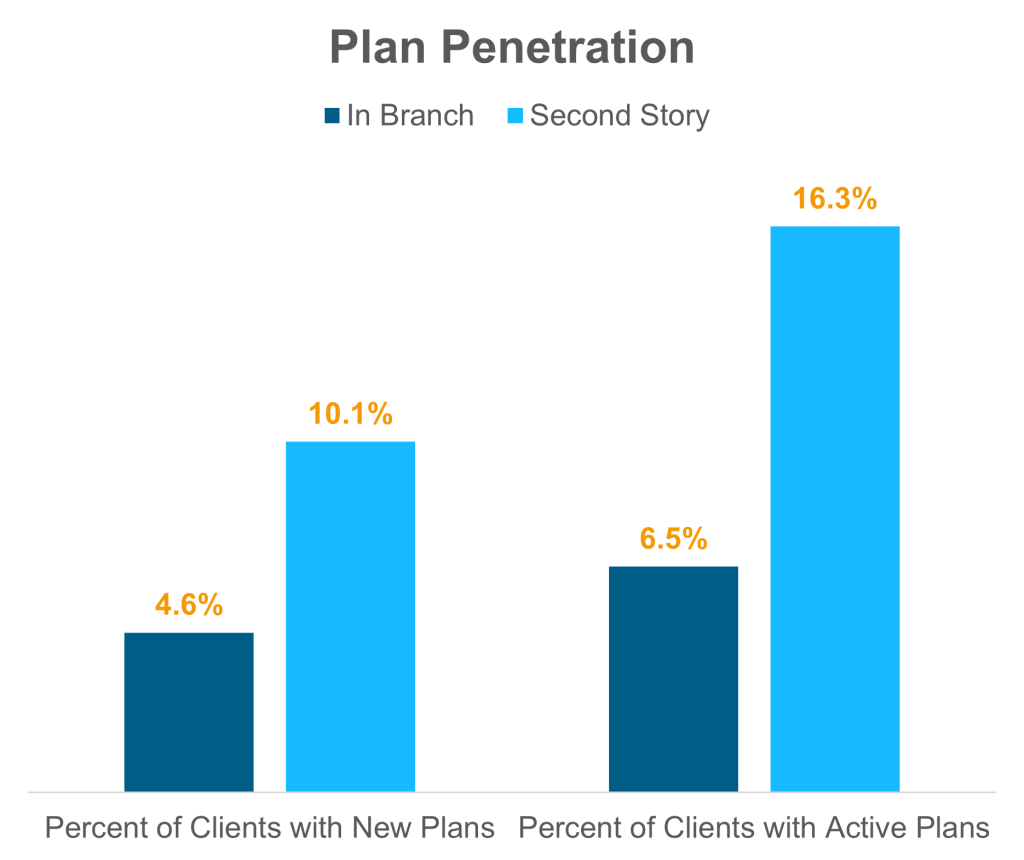

Another gauge of an advisor’s planning activity is plan penetration: how many of the advisor’s clients are engaged in planning. From this view, second story advisors do even more planning relative to branch-based advisors. On average, they are engaged with 16.3% of their clients in planning, 2.5 times the client plan penetration of branch-based advisors. And they have more than double the share of clients that have been recently engaged in planning. Of course, the branch advisors have more clients, and clients with less assets, than the second story advisors.

This analysis is part of a larger study by Kehrer Group sponsored by Raymond James Financial Institutions, “What Can Directors of Bank-Based Advisors Do to Foster a Financial Planning Culture?” Future Highlighters will examine other levers in the Director’s toolkit, and their efficacy.

In working within the Financial Institutions space, Raymond James confirms that second story advisors work in an environment conducive to planning and deepening client relationships. By reducing windshield time, second story advisors can focus more on strategic planning and serving business owners with more complex financial needs.

The ability to introduce specialized resources such as longevity planning or investment banking creates an opportunity for long-lasting relationships that complement the banking experience that these clients already enjoy. Second story advisors trade in their geography for highly productive relationships and expertise to meet clients’ evolving needs.

The additional need for technology plays a critical role in financial planning. Learning these technology tools can be time consuming; however, second story advisors are uniquely positioned to invest this time, which allows for more meaningful planning for their client relationships.

About Raymond James Financial Institutions

Raymond James serves more than 8,700 financial advisors and their clients, with more than $1.1 trillion in client assets under management. Advisors in the Raymond James Financial Institutions Division benefit from the same wide-ranging services and offerings available to other Raymond James-affiliated advisors — including investment banking services, wealth and longevity planning, robust technology tools, and a specialized financial institution support team — all designed to help partners build or expand their investment programs, deepen relationships, and generate new opportunities.