Do Associate Bank-Based Advisors Cover Their Cost?

A cornerstone of Kehrer Group’s analysis of advisor force compensation is the calculation of the effective payout – total cash compensation as a percent of revenue produced – for each of the advisor roles in banks and credit unions – branch-based advisors, second story advisors, senior advisors in teams, remote advisors in call centers, wealth advisors, and associate advisors/trainees.

It is challenging to compute the effective payout of associate advisors, because:

- Some firms roll up the associates’ production to their associated advisor, and cannot break out the revenue that associates produce personally; and

- In some firms, the associate advisors’ production falls far short of covering their compensation.

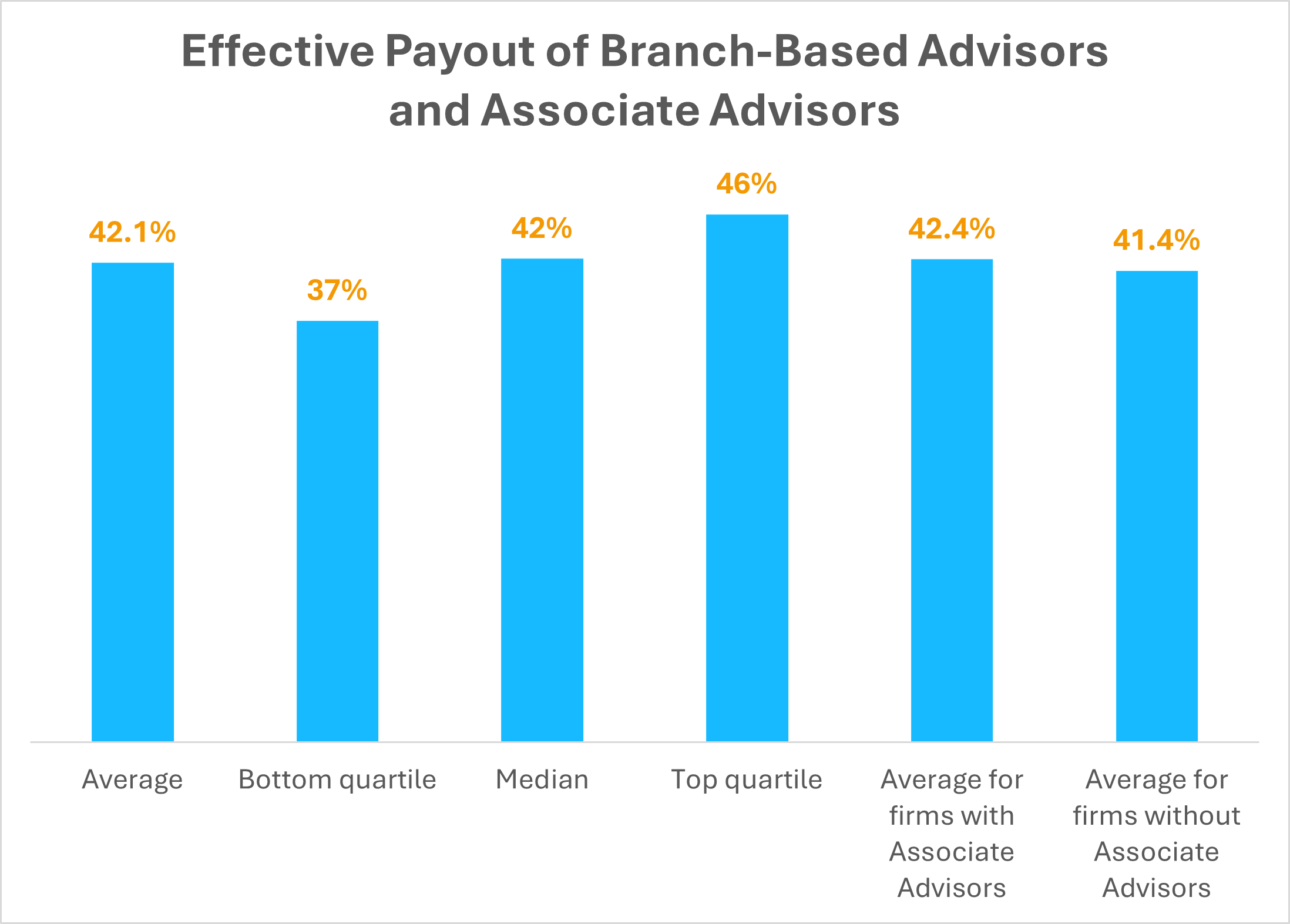

If we combine the compensation and revenue data from branch advisors and their associates, however, we can compute the effective payout of the “branch-based advisor force.”

This approach has the added benefit of comparing how much the nurturing of associate advisors costs the bank and credit union financial advice community. Associate advisor programs are the principal approach bank-based firms use to develop advisors. The data suggest that banks and credit unions spend 1 percentage point of revenue on training associate advisors. Firms with associate advisors have effective payouts of the combined branch advisors and their associates of 42.4%, while firms without associates compensate their branch advisors 41.4% of their production.

About the Kehrer Group Survey of Advisor Force Compensation

We have obtained compensation plans and actual compensation and production information covering over 1,600 advisors in more than 300 banks and credit unions, for all their advisor roles – branch-based advisors, second story advisors, senior advisors in teams, remote advisors (including call centers), wealth advisors, and associate advisors/trainees.

Learn more about the Kehrer Group Advisor Force Compensation Study here.