Not Necessarily, Kehrer Group Research Suggests

Kehrer Group research has demonstrated that financial planning is a win-win-win for the advisor, the firm, and the financial institution. A financial planning client tends to adopt the advisor, the firm, and the institution as its primary source of financial advice, concentrate its assets and financial business with the provider of the plan, and become more loyal. Yet bank-based advisors have been slow to embrace planning in their practices. In last year’s Kehrer Group benchmarking surveys, the average bank-based advisor had less than 29 active planning clients, only 7% of the 408 clients in the advisor’s book.

Advisors say that the planning process takes too much time, collecting information, processing it and discussing the findings with the client. Some firms hope to encourage more planning by providing access to a sales assistant who can take on the administrative task of researching and compiling data, so the advisor can focus on discussing the options revealed in the plan with the client. How is that working?

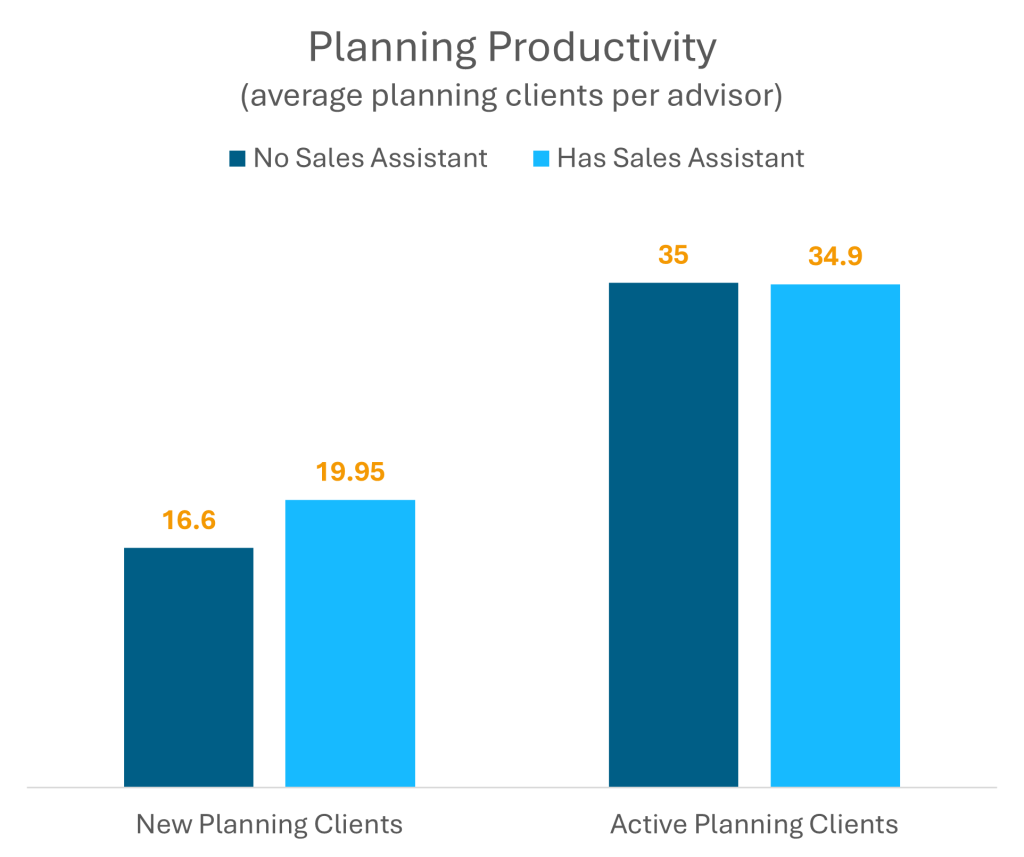

For an answer, Kehrer Group turned to its proprietary database of 3,000 individual advisors from 175 banks and credit unions. The advisors who had access to sales assistant support had an average of 34.9 active planning clients— clients engaged in planning during the year. But that is virtually the same average planning productivity as advisors with no sales assistant.

But sales assistants appear to help advisors start engaging with clients in the planning process. Advisors with sales assistants launched new planning relationships with almost 20 clients, on average, 19% better new planning client productivity than advisors without a plan. If that trend continues, advisors with sales assistant support will have higher plan productivity than their peers without sales assistants.

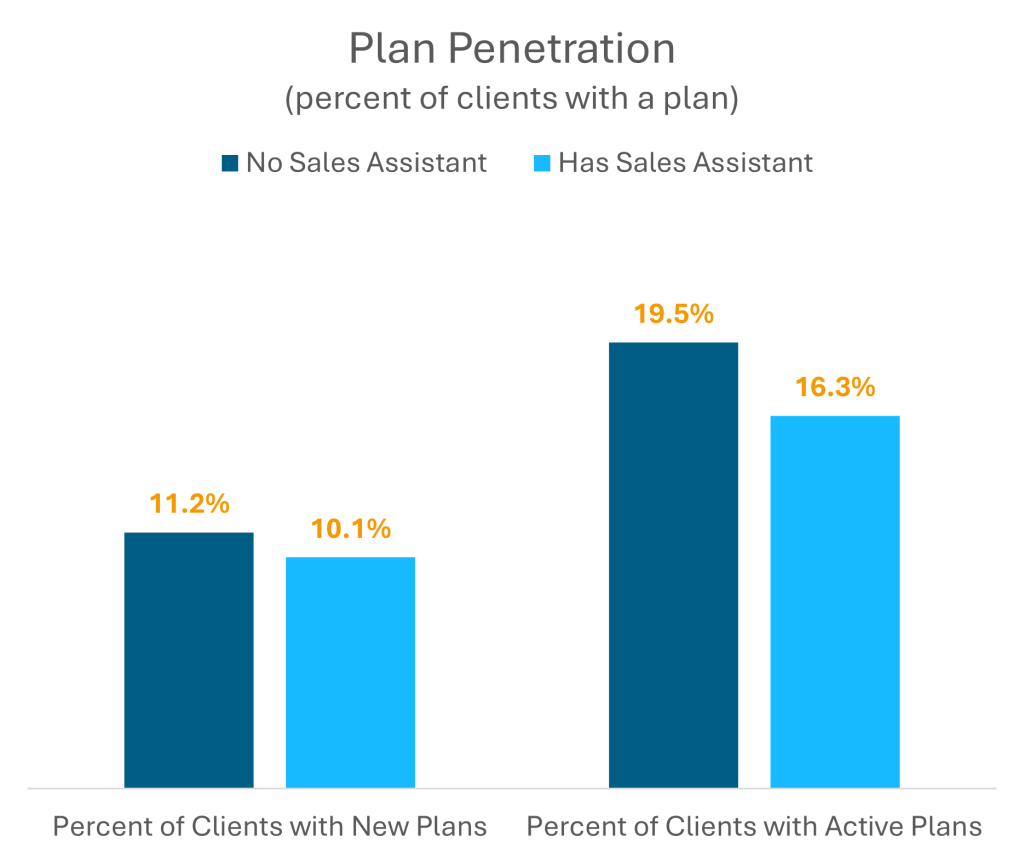

Another way to assess the extent to which an advisor has embraced planning is to see how many of the advisor’s clients have a financial plan. From this perspective, sales assistants are not delivering. Advisors with sales assistant support engage in planning with one out of every 6 clients, while those without sales assistants have client plan penetration of almost 20%, 1 of every 5 clients.

Unlike plan productivity, sales assistants are not helping increase client plan penetration faster than advisors working alone. The advisors with sales assistants have helped their advisors start planning relationships with about 10% of the advisor’s clients, somewhat less than the advisors’ colleagues who do not have access to sales assistants.

It appears that access to sales support does not necessarily help the advisor to do more financial planning. But that could be because the assistant’s time is being put toward other tasks. In the cases where sales assistants are driving more planning, what are they, the advisor, or the firm doing differently?

We turned to our sponsors from Raymond James for their additional thoughts. The advisors within the Financial Institutions Division of Raymond James do seem to have a higher affinity to financial planning, but that could be attributed to the firm’s broader cultural emphasis on planning. By providing sales assistants both the technology tools and education programs, there could be a higher number of plans overall. This also opens up a potential career development path for sales assistants interested in expanding their knowledge and pursuing paraplanning roles. With the proper training, along with the confidence from their financial advisor, sales assistants should be providing support in all elements of planning, whether data entry or data gathering. An experienced support team should be contributing all elements across the board, and since planning is a core component of the client relationship, it is essential that this function is fully integrated in their role.

This analysis is part of a larger study by Kehrer Group sponsored by Raymond James Financial Institutions, “What Can Directors of Bank-Based Advisors Do to Foster a Financial Planning Culture? Future Highlighters will examine other levers in the Director’s toolkit, and their efficacy.

About Raymond James Financial Institutions

Advisors in the Raymond James Financial Institutions Division are generating, on average $890,000 in revenue, driven by the services that only a full-service broker-dealer can provide — including investment banking services, wealth and longevity planning, robust technology tools, curated advisor training, and a specialized financial institution support team — all of which help partners grow their investment programs, deepen relationships, integrate within the broader banking teams, and generate higher revenue per advisor.