Referrals from branch staff have been a defining aspect of investment services in banks and credit unions. The availability of qualified referrals has helped attract advisors to financial institutions and helped banks and credit unions pay out 5 to 6 percentage points less of gross commissions to bank-based advisors at every level of production.

Now in the face of the health, economic and social crises, many institutions are limiting access to their branches. During the recent Kehrer Bielan teleconference on Best Crisis Management Practices, one featured speaker reported that employees in 30% of branches were working remotely, and another 45% of branches were disrupted, permitting customer access only with appointments or during limited hours. Advisors are struggling to maintain communication with their branch partners, who in turn are challenged to communicate with their clients.

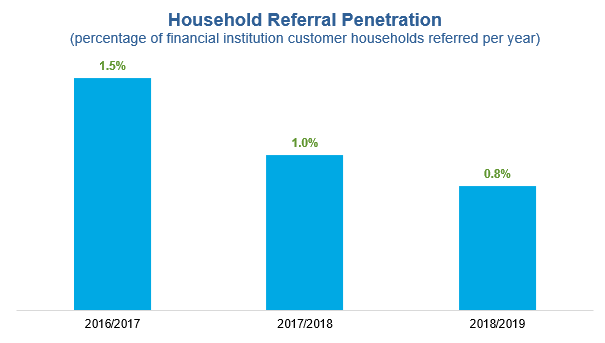

Studies show that the pipeline of prospects was already drying up before the crisis. In the Kehrer Bielan benchmarking surveys for 2016/2017, banks and credit union referred 1.5% of their customer/member households to their investment advisors. The household referral penetration plummeted 33% the following year and decreased another 20% in the 2018/2019 surveys.

The 2018/2019 Kehrer Bielan benchmarking surveys were conducted during 2019, covering financial institution experience during 2018. Eighty banks and credit unions reported their referral experience.

Prior to the crisis, declining branch traffic, the shift to online banking and accelerating branch closings all combined to choke off the flow of referrals. As we emerge from the crisis, financial institutions will have a new perspective on the value of remote interaction with clients. Can digital advice provide advisors a platform for renewed focus on client acquisition and more efficient client service?

In times of market volatility and uncertainty, advice and financial planning are more critical than ever. Firms like Ameriprise Financial that have invested in high-performing technology tools are well equipped to effectively deliver a digitally enabled experience that clients want and need.

To learn more about how Ameriprise Financial Institutions Group seamlessly integrates digital advice into its investment program offered to local banks and credit unions, please contact 800.679.1237 or go to Ameriprise.com/AFIG.

NOT FEDERALLY INSURED | NO FINANCIAL INSTITUTION GUARANTEE | MAY LOSE VALUE

Investment advisory products and services are made available through Ameriprise Financial Services, LLC, a registered investment adviser.

Securities offered by Ameriprise Financial Services, LLC. Member FINRA and SIPC.

© 2020 Ameriprise Financial, Inc. All rights reserved.