Practice Management Insights from the Kehrer Group Benchmarking Surveys

The branch referral model at the core of most bank and credit union retail wealth management businesses has resulted in advisors stockpiling clients to the point that serving all of them is problematic; either many clients are underserved, or they constrain the advisor’s productivity. Many directors of retail wealth management advisors in financial institutions have been encouraging their advisors to cull their books of less productive clients, assigning those clients to less experienced advisors, investment call centers, or digital platforms. This frees the advisor to dig deeper with more productive clients and develop client referrals, helping them grow assets and revenue.

How’s that going?

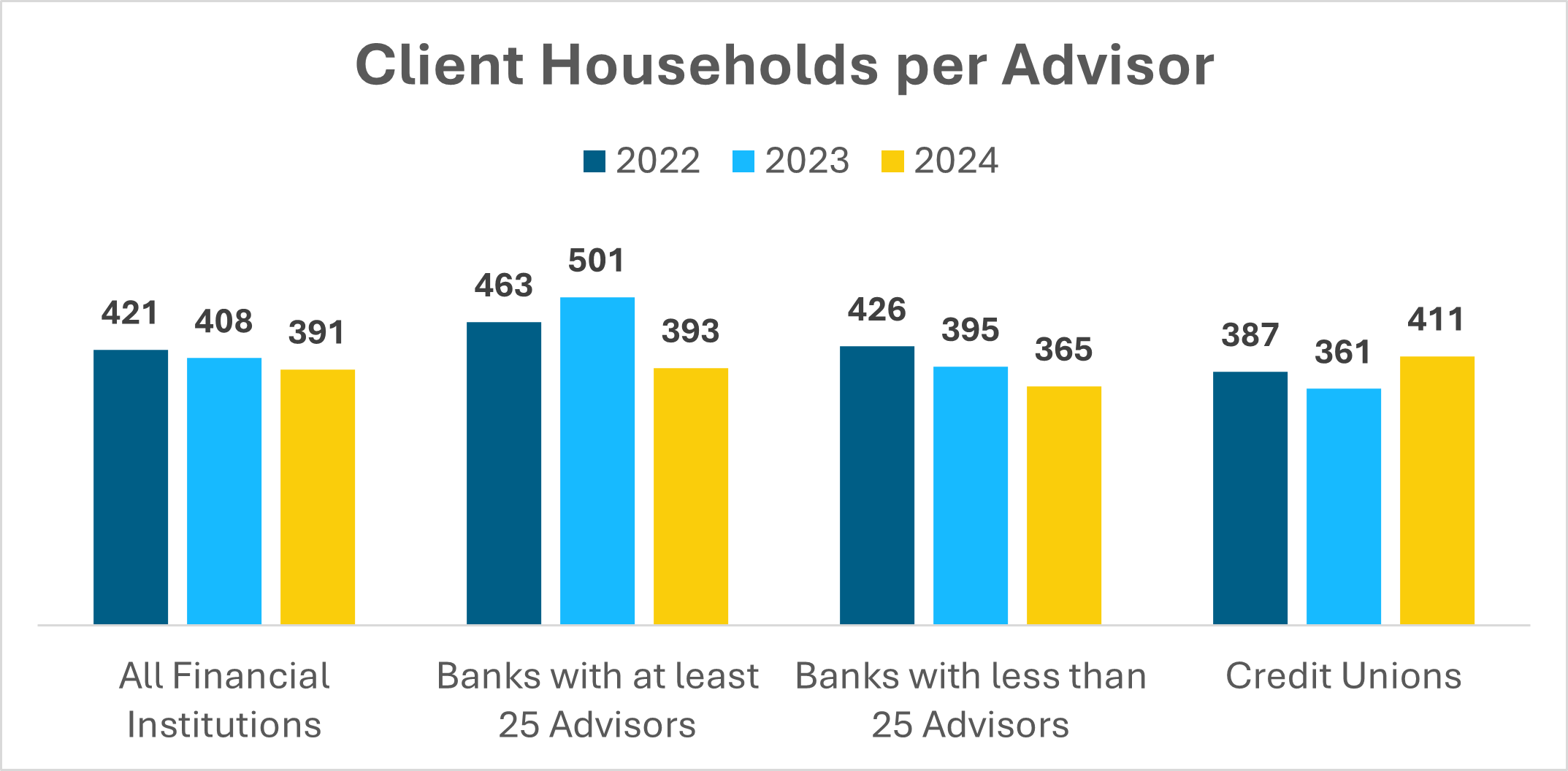

The typical advisor in our 2024/2025 benchmarking survey had 391 client households, 4% fewer than the previous year. In fact, financial institution-based advisors have made slow but steady progress achieving smaller client books over the past two years.

Advisors in larger bank-based firms led the way last year, reducing the number of clients per advisor by 22%, after backsliding during 2023. Advisors in smaller bank firms have consistently reduced their average client headcount by 6% or 7% each year. On the other hand, advisors in credit unions, which began the year with the smallest client books, saw their average client books bloat 14% to now have the largest average number of clients per advisor.

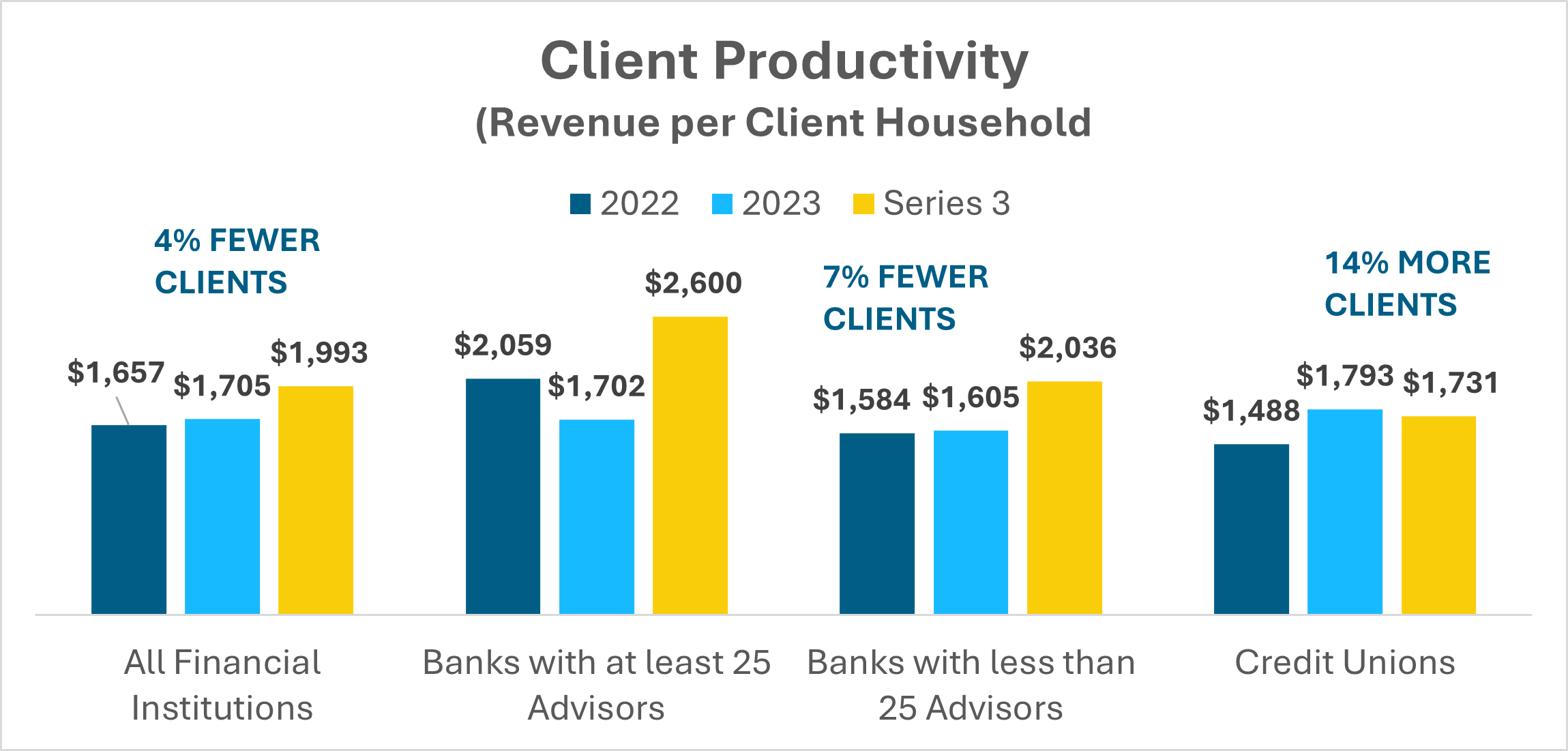

We see the impact of smaller client books reflected in the increased productivity of the remaining clients. As financial institution-based advisors have culled their books, the average revenue per client has increased, by 3% during 2023 and 17% last year. The steady decrease in average book size in banks with less than 25 advisors has been matched by a steady increase in client productivity.

Average revenue per client fell during 2023 in banks with at least 25 advisors when client books swelled but rebounded during 2024 when client headcount was trimmed. And advisors in credit unions gave back some of the 2023 gains in client productivity when they increased the average number of clients per advisor.

About the Data

This Highlighter draws on data from the 2024-2025 Kehrer Group Benchmarking Survey. Kehrer Group has been benchmarking the investment services business in financial institutions since the early 1990s. 183 banks and credit unions, which deploy 4,546 advisors, participated in this year’s survey during the first quarter of 2024. We publish the survey findings in three segments:

- Firms with at least 25 advisors (sponsored by Cetera)

- Firms in Regional & Community Banks with less than 25 advisors (sponsored by Ameriprise Financial Institutions Group and Financial Resources Group)

- Firms in Credit Unions (sponsored by Ameriprise Financial Institutions Group and Financial Resources Group)