Practice Management Insights from the Kehrer Group Benchmarking Surveys

Referrals from client facing branch staff are the foundation of retail wealth management in banks and credit unions. Access to the institution’s customers/members has helped the institution recruit and retain advisors, and pay them less than similar advisors in nonbank firms. But the days of branch staff referring up to 2% of their customers to branch-based advisors have faded in the rearview mirror. Banks have closed branches, branch traffic has shrunk in the remaining branches, banks have turned away from the personal banker model in favor of peak load staffing, and referrals had steadily declined over the past decade.

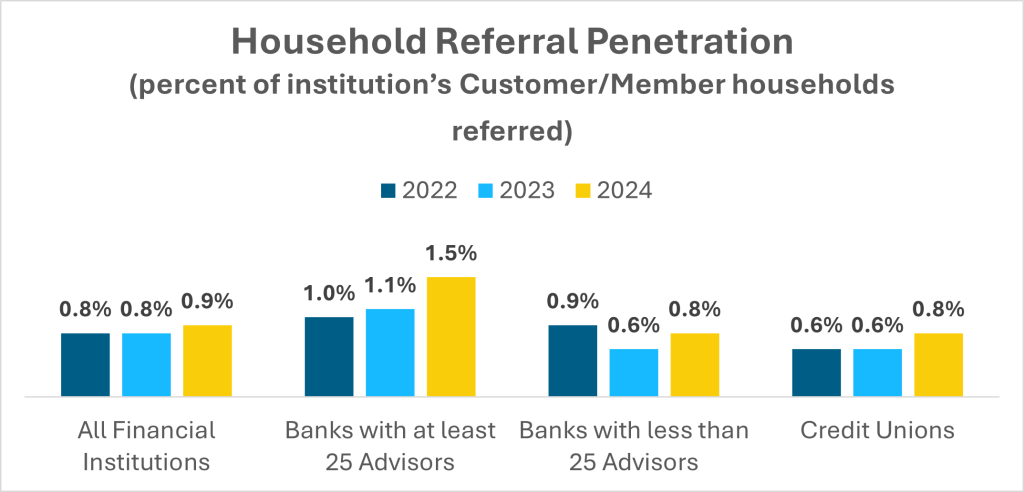

After years of declining branch referrals, the downward spiral paused in 2023, although it continued in banks with less that 25 advisors. Last year, however, there was a marked increase in the referral flow, the 183 banks and credit unions in the Kehrer Group benchmarking survey referred 0.9% of their customers/members to their financial advisors, a 13% improvement over the previous year.

Large banks led the way, increasing their household referral penetration 36% to 1.5%. Referrals also rebounded in the smaller banks and credit unions.

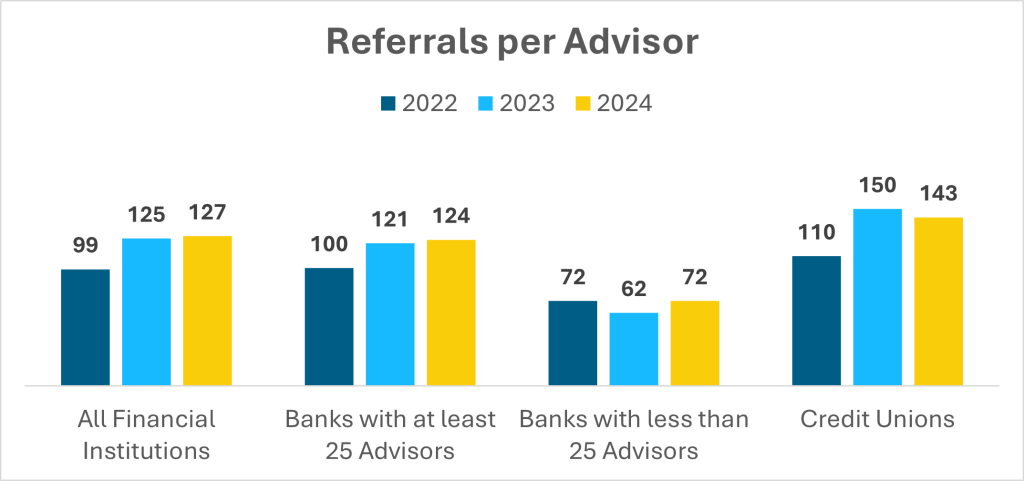

The typical financial institution-based advisor probably didn’t notice this upsurge in referrals, because they received just about the same number of referrals as the previous year. How can that be? Because banks and credit unions added to advisor headcount during the year, and the increased referral flow was spread among more advisors.

While referrals surged in banks with at least 25 advisors, advisor headcount grew 3.2%, offsetting the additional referrals. Credit unions added even more advisors, relatively – a 7.2% increase. So a 33% increase in referrals was spread among even more advisors, resulting in a small decline in referrals per advisor.

The data suggest that banks and credit unions have found the answers to resuscitate referrals to their advisors. That is good news for directors hoping to grow their advisors headcount, for the increased referral flow will help sustain the new advisors.

Many institutions are achieving this by reengaging branch staff and licensed bankers through targeted referral training and clear alignment with their advisor teams.

A large regional bank with more than $100 billion in assets and a multi-state footprint, partnered with Midwood Financial Services to address this exact challenge of boosting referrals from licensed bankers to financial advisors. The institution needed a way to increase banker confidence and consistency when identifying and referring clients for financial guidance.

Midwood developed and delivered a customized, multi-phase training program focused on discovery conversations, client profiling, and referral confidence. The initial rollout to licensed bankers generated immediate results, producing a measurable increase in referral activity and advisor engagement. The success was so significant that the bank expanded the program enterprise-wide, training more than 900 bankers across its footprint.

By focusing on referral language, equipping bankers with conversational tools, and aligning training with leadership coaching, the institution established a sustainable referral culture that continues to deliver results.

About the Data

This Highlighter draws on data from the 2024-2025 Kehrer Group Benchmarking Survey. Kehrer Group has been benchmarking the investment services business in financial institutions since the early 1990s. 183 banks and credit unions, which deploy 4,546 advisors, participated in this year’s survey during the first quarter of 2024. We publish the survey findings in three segments:

- Firms with at least 25 advisors (sponsored by Cetera)

- Firms in Regional & Community Banks with less than 25 advisors (sponsored by Ameriprise Financial Institutions Group and Financial Resources Group)

- Firms in Credit Unions (sponsored by Ameriprise Financial Institutions Group and Financial Resources Group)

About Midwood Financial Services

Midwood Financial Services is a national annuity distributor and training partner serving banks and credit unions across the country. Through its dedicated Training Division, Midwood provides product-agnostic, value-added programs that help their clients elevate advisor productivity, strengthen client relationships, and drive measurable business growth at no additional cost to the institution.

Midwood offers a wide range of high-quality, custom-built curriculum that is designed and delivered by a national team of Regional Training Directors. Each program is tailored to the institution’s culture, client demographics, and business goals, helping advisors and bankers alike turn education into measurable performance.