Deeper Dive into the Coming Great Wealth Transfer

Seems like every time we read a wealth management article the size of the coming Great Intergenerational Wealth Management Transfer gets larger. Over $70 trillion? But US households own only $73 trillion of financial assets altogether. And Cerulli pegs US assets under management at $51 trillion.

New research by RFI Global on their highly regarded MacroMonitor data estimates that $45 trillion in assets will be transferred to the next generation in the next data. Their research transparency empowers us to understand their methodology and interpret the implication for financial advisors.

RFI Global finds that there are 21.8 million households where the heads will all exceed the US life expectancy of 79.3 years in the next decade. These households have over $45 trillion In assets, 30% of all US household assets. We should probably consider the $45 trillion to be an upper limit to what will be transferred over the next ten years, because not all of the 70+ heads of household will pass away.

But let’s look at these estimates from the financial advisor’s perspective. Almost $19 trillion of the assets of the 70+ households are in real estate. For financial advisors, the more relevant assets are the $24 trillion of financial assets (which include pensions and 401k accounts), or the $22 trillion in investable assets.

Financial advisors probably look at these estimates in two ways:

- How can I capture some of this money in motion?

- How can I retain assets when their ownership passes to the next generation?

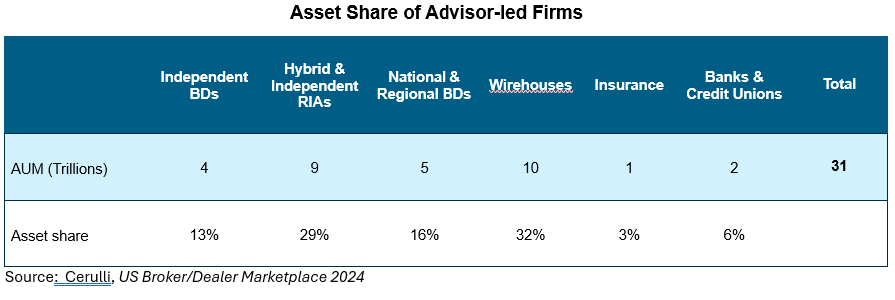

For the latter objective, it is useful to note that currently, per Cerulli estimates, 61% of the $51 trillion in US assets under management is “advisor led,” as opposed to self-directed (Vanguard, Fidelity, etc.) or held in Trust. And only 6% of those assets are managed by bank-based advisors. If, like the general population, bank-based advisor clients who are 70+ own 37% of the advisor’s AUM, the size of the pie they have to defend is $740 billion (i.e., 37% of $2 trillion. Not chump change, but not in the trillions.

Addressing both objectives, Luke Allchin (RFI Global’s Director of Research) and James Langford (Commercial Vice President of the MacroMonitor) described the characteristics of the Transferers and the likely Inheritors during the Kehrer Study Group on Integrating Wealth Management. They pointed out ways in which the Transferers are unprepared to pass assets on to the next generation, where the Transferers hold their investable assets, and what is driving the investment decisions of recent Inheritors.

The Kehrer Study Group on Integrating the Delivery of Wealth Management has been working on alternative paths to increasing the breadth and depth of wealth management penetration in financial institutions since 2011. This year’s meeting was held July 22-23 at the Carolina Inn on the campus of The University of North Carolina in Chapel Hill.

About MacroMonitor

RFI Global’s MacroMonitor offers the most extensive data set of US households. The study goes into field every 2 years and has been running since 1978.

The 2024/25 study is comprised of 5,000 household interviews, which were conducted online via desktop and mobile.

Respondents, all of whom are decision-making heads of households, are recruited via a probability-based sampling methodology.

Probability-based sampling, by design, mirrors the composition of US households. To enhance precision, the sample undergoes additional refinement through the derivation of the weight variable. This variable encompasses various demographic profiles including age, gender, race, and household characteristics such as family status, income, education level, and home ownership, as well as geographic attributes like region and area of residence.

In addition to the 4,000 interviews conducted as part of the core sample, a further 1000 interviews are conducted as oversamples. This includes Ultra-High Financial Assets, Young, Hispanic, Black, and Asian Households, all of which ensure robust samples of key household profiles and allow for greater granularity when segmenting the data.

About RFI Global

RFI Global is the only global data and insights company focusing exclusively on financial services. We empower financial service leaders with the market intelligence they need to drive innovation, enhance customer experience and accelerate growth. Partnering with the world’s top financial institutions, our expert team delivers tailored insights through a unique hybrid syndicated approach, drawing from over 200,000 consumer and 60,000 business interviews each year.

Find out more about RFI Global here: Data and Insights for Banking and Financial Services | RFI Global